Calculate pa sales tax

There is base sales tax by Pennsylvania. To verify your Entity Identification Number.

Pennsylvania Sales Tax Guide For Businesses

Nine-digit Federal Employer Identification Number or Social Security number or your 10-digit Revenue ID.

. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation. Eight-digit Sales Tax Account ID Number. Then deduct the value of.

Ad Integrates Directly w Industry-Leading ERPs. Your household income location filing status and number of personal. Businesses required to make prepayments for sales use and hotel occupancy tax by the 20th of each month and having an actual tax liability for the third quarter of the previous year of at.

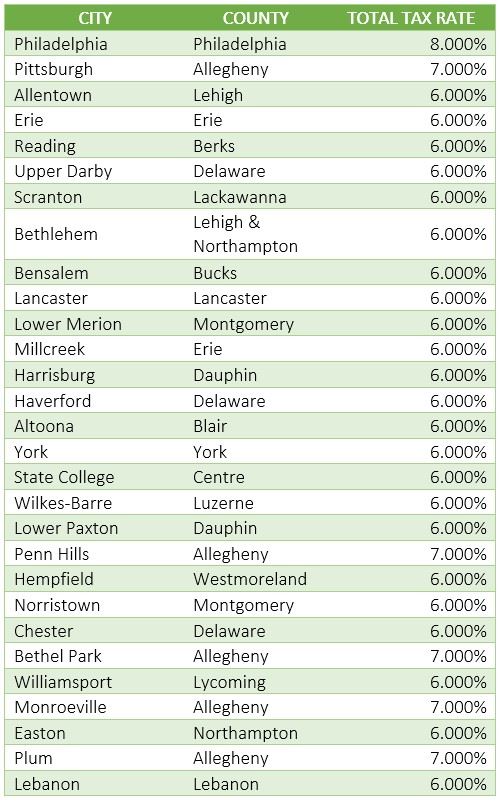

The Pennsylvania sales tax rate is 6 percent. Maximum Local Sales Tax. Reduce audit risk as your business gets more complex.

Multiply price by decimal. Fast Processing for New Resale Certificate Applications. Calculator for Sales Tax in the Philadelphia.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Your average tax rate is 1198 and your. Inheritance and Estate Tax.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation. Ad Fast Online New Business Pennsylvania Sales Taxes. The price of the coffee maker is 70 and your state sales tax is 65.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Average Local State Sales Tax. Choose city or other locality from Pennsylvania below for local Sales Tax calculation.

First take the purchase price for your vehicle. If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536. Discover The Answers You Need Here.

Divide tax percentage by 100. 65 100 0065. You can see the total tax percentages of localities in the buttons.

List price is 90 and tax percentage is 65. Maximum Possible Sales Tax. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia.

45 percent on transfers to. Use this simple formula to calculate how much you need to expect to pay in state sales tax on your car. Pennsylvania Income Tax Calculator 2021.

Once youve found the correct sales tax rate for your area you need to figure out how much to charge each customer on their purchases. 6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local. The use tax rate is the same as the sales tax rate.

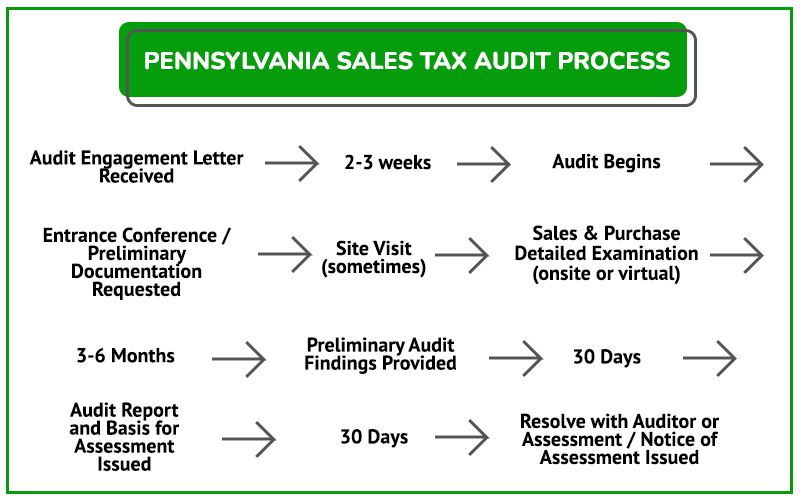

Counties cities and districts impose their own local taxes. Before-tax price sale tax rate and final or after-tax price. Step Two - Calculate Penalty and Interest Penalty is calculated by multiplying the total tax due by 5 percent for each month or portion of a month the tax remains unpaid.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Pennsylvania State Sales Tax. Use the sales tax formula below or the handy.

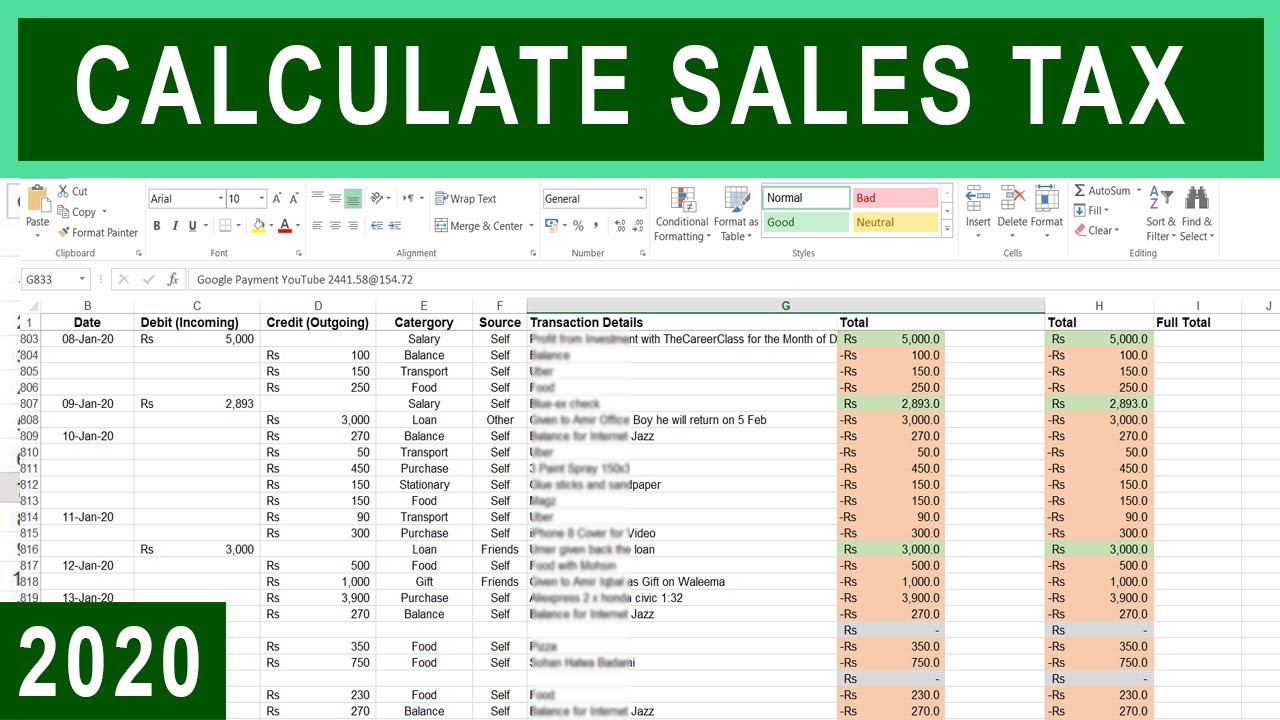

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Calculator Taxjar

Pennsylvania Sales Tax Guide For Businesses

Sales Tax Calculator Taxjar

Pennsylvania Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Pennsylvania Sales Tax Guide For Businesses

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax In Excel

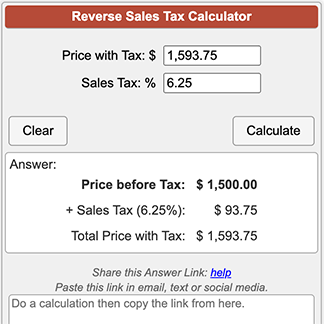

Reverse Sales Tax Calculator

Pennsylvania Sales Tax Small Business Guide Truic

Everything You Need To Know About Restaurant Taxes

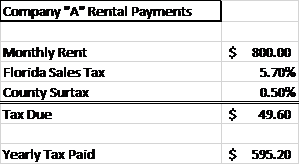

How To Calculate Fl Sales Tax On Rent

How To Calculate Sales Tax In Excel

Sales Tax Calculator Taxjar

Sales Tax On Grocery Items Taxjar

Pennsylvania Sales Tax Guide And Calculator 2022 Taxjar